Our partners

ProNoblis Services is supported by the ProFit Brandenburg programme for developing an IT platform for corporate financing. The platform will digitalize corporate financing through matching- and rating-algorithms and artificial intelligence as well as private wealth creation for individual and institutional investors. Our project contains not only experimental research and industrial development.

The goal of the project is the development of an online platform for a fully automated credit application, identification check, credit rating - & decision and payout for the B2B credit products offered on our platform. We want to accelerate the ProNoblis finance process - digital and fast. Also, the investment process for institutional and private investors using the financial products available on the platform, to directly and digitally invest in SMEs, shall be digitalized.

The project is supported by the Ministry for Economic Affairs, Labour and Energy of Brandenburg and the ILB and funded by the European Fund for Regional Development (ERDF) through the funding programme ProFIT Brandenburg.

About

ProNoblis Services AG & Co. KG creates need-based financing solutions for small and medium enterprises (SMEs) and creates profitable investment opportunities for private and institutional investors simultaneously. ProNoblis Services AG & Co. KG is therefore the first FinTech giving individual and institutional investors the possibility to invest in SMEs using three asset classes (loan, subordinated loan and Working Capital) directly and digitally, earning a risk-adequate return.

Die ProNoblis AG ist bereits seit mehreren Jahren erfolgreich im Finanzmarkt mit Fokus auf Finanzlösungen für kleine und mittlere Unternehmen (KMU) tätig. Seit 2013 ist die ProNoblis AG professioneller Partner für mittelständische Unternehmen mit strategischem und operativem Beratungsbedarf im Finanzbereich. ProNoblis Services AG & Co. KG is the digital subsidiary of ProNoblis AG and transforms the ProNoblis model for the digital world.

What does ProNoblis Services AG & Co. KG do?

The goal of ProNoblis Services AG & Co. KG is to match small and medium-sized enterprises (SMEs) and investors easily, in order to create alternatives to conventional banking products. We offer new financing products to SMEs on our platform and give investors the opportunity to invest directly into solid and promising SMEs.

We fill the structural gap in financing German SMEs

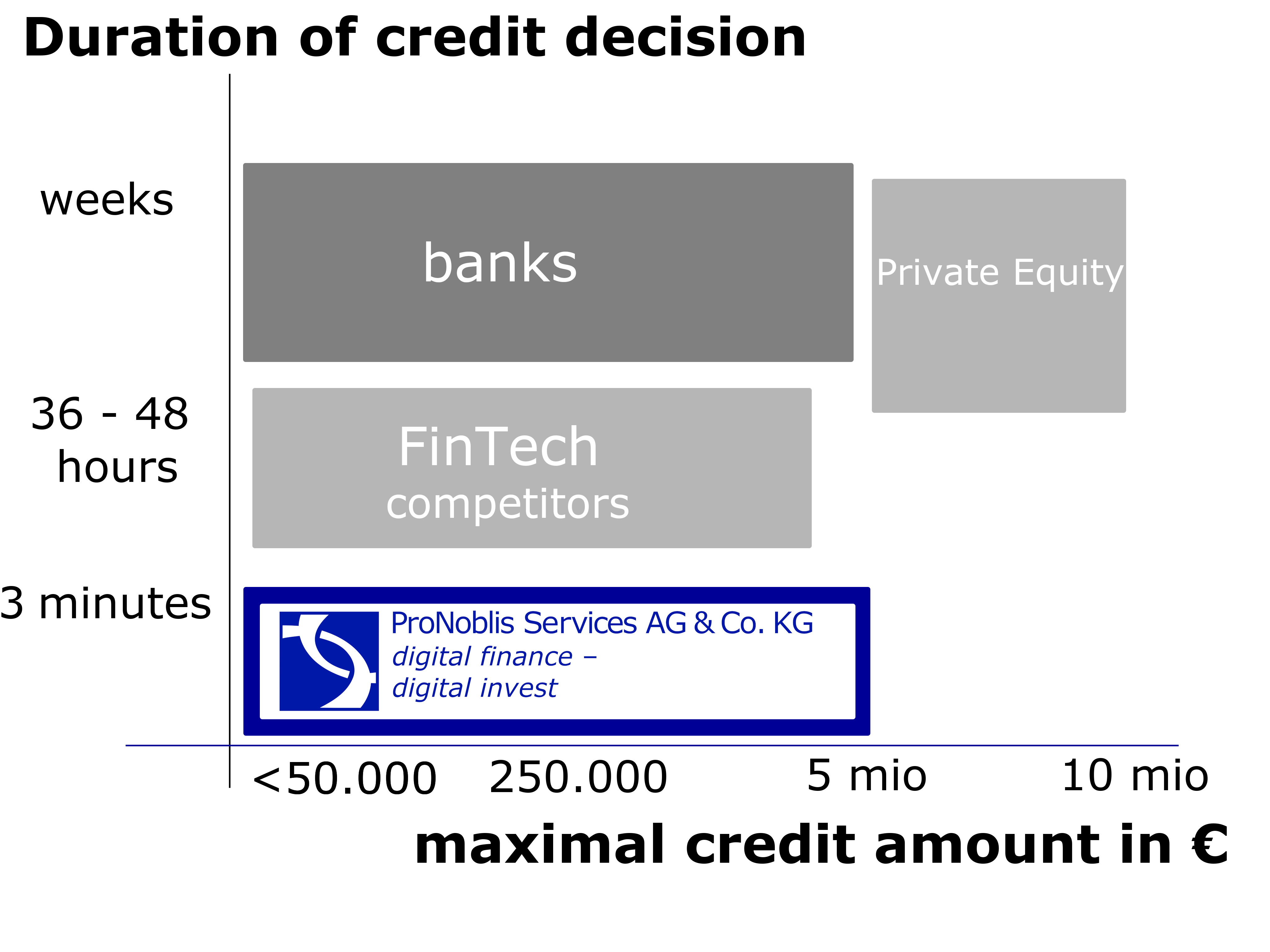

We offer credit approvals within three minutes and createreal alternatives for bank financing products, leasing or factoring.

We are private wealth creation partner for private investors

Attractive return between 2,9 and 9,0% p.a., no deal without collaterals, optional up to 75% risk hedging with Credit Default Swap Certificate (CDSC).

ProNoblis offers investment opportunities in solid SMEs.

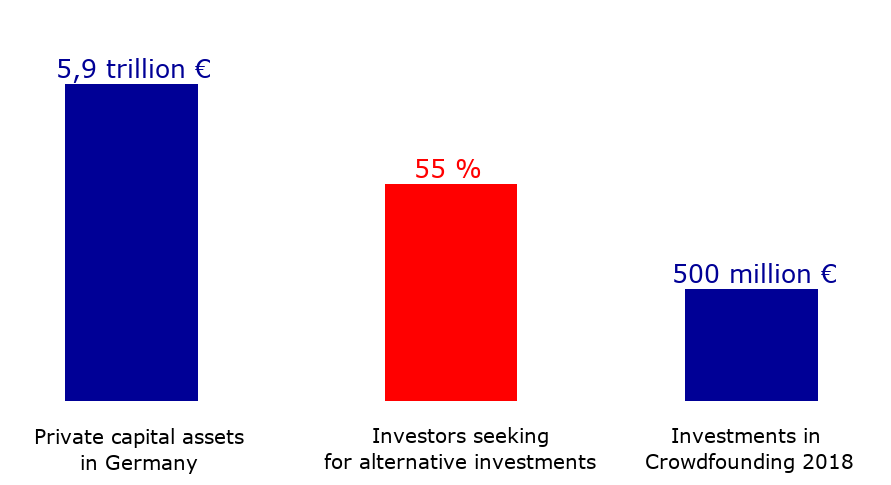

Private and institutional investors face the lack of attractiveness of traditional banking products like life insurance and savings books. Sparbriefe, Lebensversicherungen, oder Sparbücher.

100% solid SMEs

Invest directly in attractive and innovative Enterprises and receive an outstanding return on investment of up to 9,0% p.a.

ProNoblis Services enables you to invest your capital directly, meaningfully and profitable into SMEs and earn returns up to 9,0% p.a.. Additionally, the ProNoblis system gives you the opportunity to diversificate your risk broadly.

You can start investing from 1.000 €.

ProNoblis Services closes the structural financing gap for Enterprises in Germany

Especially SMEs (=approx. 99,5% of all companies in Germany) face difficulties in adopting to the fundamentally changed practices of credit approval since the recession in 2007. Because of the aggravated requirements for credit approval (Basel III & Basel IV) the increased rejection rate leads to 73,3% of SME describing their financial supply as insufficient, with a credit demand of 133,5 billion € in the period between 2005 and 2016.

Credit decision within 3 minutes

You receive your credit approval in no more than 3 minutes.

Further, SME have little or no access to alternative financing sources on the public capital markets. SME accordingly require innovative, bank-accompanying financing instruments as complement or alternative for operating loans or overdraft facilities.